This week in Fintech news, we are diving into the thriving Mexican Fintech industry, despite the tariff threats from President Trump.

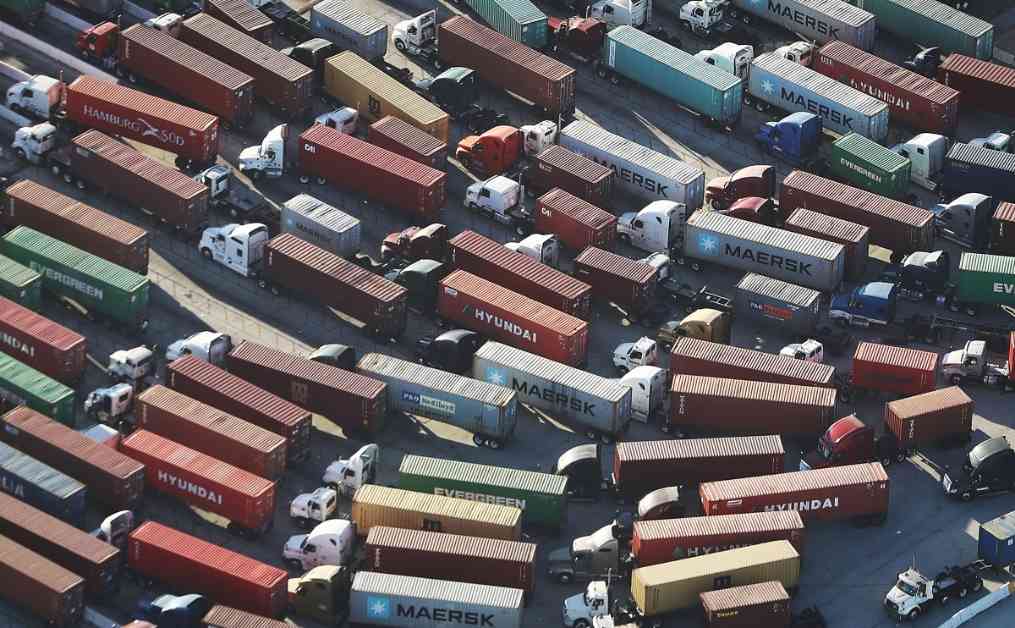

The startup Solvento, co-founded by Jaime Tabachnik, is making waves in Mexico by providing financial services to trucking companies. Recently, the company closed a successful $12.5 million Series A funding round led by Cometa, a venture capital firm. Solvento offers modern financial solutions such as financing and automated payments to the trucking sector, increasing transparency and liquidity.

Looking ahead, Latin America’s Fintech market is showing promising growth potential. In 2024, $2.6 billion has been invested in Fintech companies in the region, a significant increase from $1.5 billion in 2023. While these numbers may not be as high as previous years, it indicates a positive trend for the market. Investors like Mike Packer from QED Investors believe that Latin America is an underfunded region with great global opportunities for entrepreneurs to make a difference.

In other funding news, Cardless secured $30 million to expand its co-branded credit card business, while StoreCash closed a $3.7 million seed round for its instant cash-back app aiming to help Americans build generational wealth. Additionally, German Fintech unicorn N26 reported its first-ever quarterly profit, generating €2.8 million in net operating income in the third quarter of 2024.

In other headlines, the UK is set to introduce new crypto regulations, including stablecoins and staking services. Flipkart co-founder Binny Bansal has left PhonePe’s board, and Revolut is planning to launch mortgages, smart ATMs, and business credit products. Furthermore, popular payment apps like Apple Pay, Cash App, and PayPal are expected to be treated more like banks in the future.

Overall, the Fintech industry in Mexico and Latin America is showing resilience and growth despite external challenges. With innovative startups and increasing investments, the future looks bright for Fintech in the region.