Family offices are becoming increasingly prominent in the startup investment world, contributing significantly to overall deal value. According to a recent report by PwC, family offices were involved in 27% of startup deals in the first half of 2023. However, for founders seeking investment from family offices, navigating this investor class can be challenging due to their elusive nature and lack of public presence compared to traditional venture capitalists.

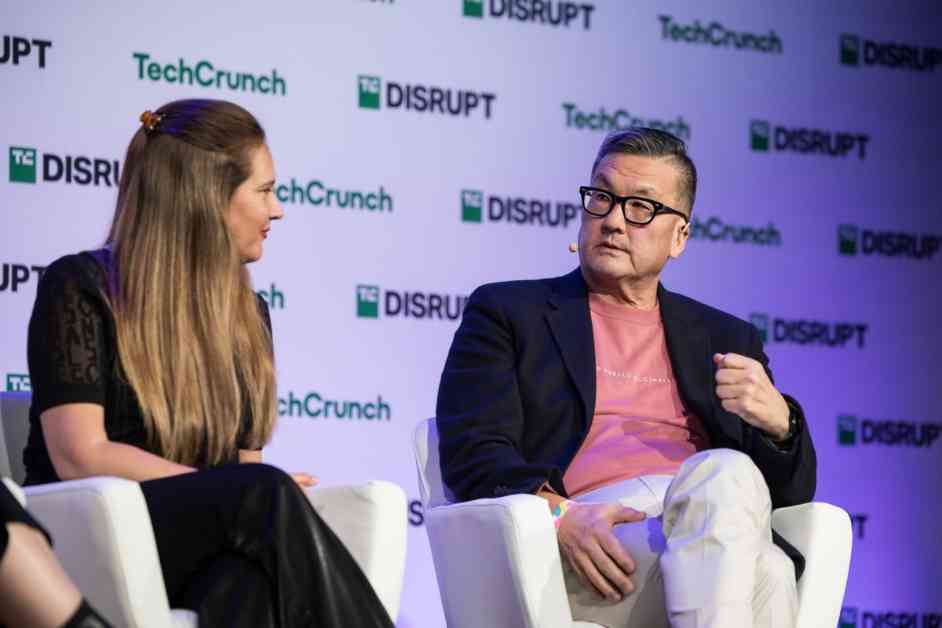

During a recent panel at TechCrunch Disrupt, several family office investors emphasized the importance of aligning with the sector in which a startup operates. Bruce Lee, founder and CEO of Keebeck Wealth Management, advised founders to target family offices whose wealth was generated in the same sector as their startup. This alignment ensures that the family office can provide strategic value and expertise to the investment, beyond just financial support.

Eti Lazarian, a principal at Elle Family Office, echoed this sentiment, highlighting the value of investing in businesses that complement the family’s existing interests. When a family office invests in a sector related to their own business, they can offer valuable insights, collaboration opportunities, and emotional investment in the success of the startup. This emotional connection sets family offices apart from traditional VCs, as they are often more patient and flexible in their approach to investments.

In addition to seeking alignment with family offices, founders can increase their chances of connecting with these investors by attending industry-specific or regional conferences where family offices are likely to be present. Once a founder secures a meeting with a family office, it is essential to tailor the pitch to focus on projections, metrics, and tangible results rather than vague promises of future success.

Overall, the key takeaway for founders seeking family office investment is the importance of sector alignment and strategic fit. By targeting family offices with expertise in their industry and presenting a well-defined pitch focused on concrete outcomes, founders can increase their chances of securing investment and benefiting from the unique advantages that family offices offer as investors. Remember, it’s not just about the money; it’s about finding the right partner who can add long-term value to your startup.